The stock market is often mistaken for gambling by those who are unfamiliar with the concept of investment. In this blog post, we will delve deeper into the topic of “is stock market gambling” and the “difference between investment and gambling” and help you understand the key characteristics that set them apart and differentiate one from another. So, let’s begin.

Is Stock Market Gambling?

The stock market is not gambling but a platform for companies to compete and innovate to drive growth and increase shareholder value. While there may be some uncertainty and risk involved, the ultimate goal of stock trading is to make informed decisions based on market trends and company performance rather than relying on luck or chance. Investing in the stock market requires research, strategic planning, and a long-term perspective, making it a viable means of building wealth and achieving financial goals.

One key characteristic that sets stock market investing apart from gambling is the investor’s level of control and decision-making. In the stock market, investors can research and analyze companies, industries, and market trends and make informed decisions about where to invest their money. In gambling, on the other hand, the outcome is primarily determined by luck, and the individual has little or no control over the outcome.

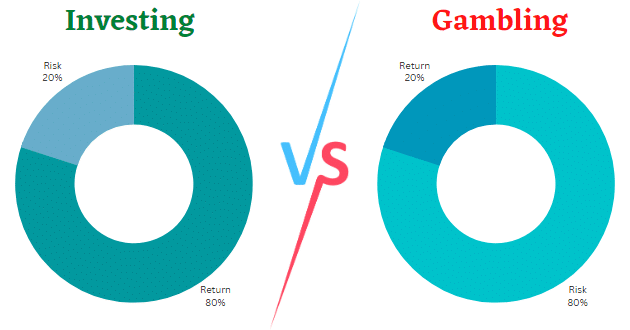

Another important distinction is the level of risk and return. In the stock market, the potential return on investment can be higher than the level of risk, making it a viable and potential source of income for those who take the time to learn the stock market, understand their psychology and emotions, and develop a plan for managing them.

Self-awareness, discipline, and emotional regulation are crucial in successful stock market trading. In contrast, in gambling, the risk is typically more significant than the potential return, making it less reliable for building wealth. It’s also important to note that the emotional highs and lows in gambling can be much more intense as the outcome is primarily determined by luck rather than by informed decisions.

This clears the questions “is stock market gambling?”, Now Lets try to understand the key Difference Between Investment and Gambling.

Difference Between Investment and Gambling (Table)

| Particulars | Investment | Gambling |

| Basis | Based on research and analysis | Based on chance or luck |

| Time Horizon | Long-term perspective | Short-term perspective |

| Risk vs. Return | Potential for higher returns than risk | Risk typically greater than potential returns |

| Management Style | Active Management Required | Passive Management |

| Control | Involves decision-making and control | Involves little control or no control over outcome |

| Knowledge Required | Understanding of market trends and company performance | None |

| Psychology | Understanding of one’s own psychology and emotions | Involves emotional highs and lows |

Until now we understand “is stock market gambling or not” and key “Difference Between Investment and Gambling”, now let’s see the role of skill and knowledge in investment vs in gambling.

The role of skill and knowledge in investment vs in gambling

The role of skill and knowledge in investment and gambling is crucial when distinguishing between the two. Knowledge and skills play a vital role in making profitable decisions in the stock market. An investor who is well-versed in analyzing financial statements, understanding market trends, and using technical indicators is more likely to make informed decisions and achieve better investment returns. These skills can be acquired through education and experience, including knowledge of financial accounting, economics, and market analysis.

On the other hand, in gambling, knowledge of the game, strategy, and odds can undoubtedly improve the chances of winning, but luck still largely determines the outcome. For example, in a game of poker, a player who knows the rules understands the odds, and has developed a strategy may have a better chance of winning than a player who is new to the game. However, even the most skilled and knowledgeable poker player may still lose to a player who gets lucky with their cards. In short, it largely depends on luck.

Also read: 35 Powerful Candlestick Patterns in Stock Market – Explained

Why Stock Market Investing is More Than Just Gambling

Trading or investing in the stock market is often compared to running a business. Both involve making decisions based on research, analysis, and planning, and both require a long-term perspective and a focus on building wealth and achieving financial goals.

In trading or investing, the goal is to make informed decisions based on market trends, company performance and other relevant factors to generate profits. This requires knowledge and skills in financial analysis, market trends, and risk management. It also requires discipline, patience and a sound understanding of one’s psychology and emotions.

On the other hand, gambling is more akin to a game of chance, where the outcome is primarily determined by luck. In gambling, the goal is to win money, but the potential return is often lower than the level of risk involved. Gambling does not require knowledge or skills but a willingness to take risks and a certain level of emotional tolerance.

Conclusion to Is Stock Market Gambling?

Stock market trading and gambling may have some similarities, but they are ultimately very different regarding their goals, methods, and outcomes. Trading in the stock market is a business that requires discipline, patience, and a long-term perspective. It involves researching, analyzing and using technical analysis to make informed decisions based on market trends and company performance.

In contrast, gambling is a game of chance that relies on luck rather than skill or knowledge. Investing in the stock market requires much effort, research, planning, and an understanding of the market and one’s psychology. It is crucial to maintain consistency, self-control and emotional well-being. It’s also essential to diversify the portfolio and manage risks.

It is not easy to predict the stock market, but it can be a great source of generating wealth if approached in a thoughtful and disciplined way. While gambling may provide a short-term thrill, it is not reliable for building wealth. The key takeaway is that traders should approach the stock market as a business rather than a game of chance by seeking knowledge, developing a strategy, monitoring, using technical analysis, diversifying their portfolio, and managing their risks.

I hope the above explanation helps you to understand “is stock market gambling” and the “difference between investment and gambling” in a simple way. Let me know your thoughts in the comment section.

Happy Learning 😊 & Happy Trading 😊.