The trend is a fundamental element of technical analysis. Without understanding the trend, it is difficult to make correct trading decisions. Every trader should know how to identify trends and trend reversals.

This topic is simple to understand, and it’s important to learn about trends so that you can identify them accurately and use them in your trading.

You might have heard this: “The trend is your friend, until the end when it bends.” The key to buying stocks is to remain patient, even during minor price fluctuations, until you can identify the moment when the trend shifts direction.

In short, if you take trades with the trends, you will make money, and if you go against the trend, you will lose.

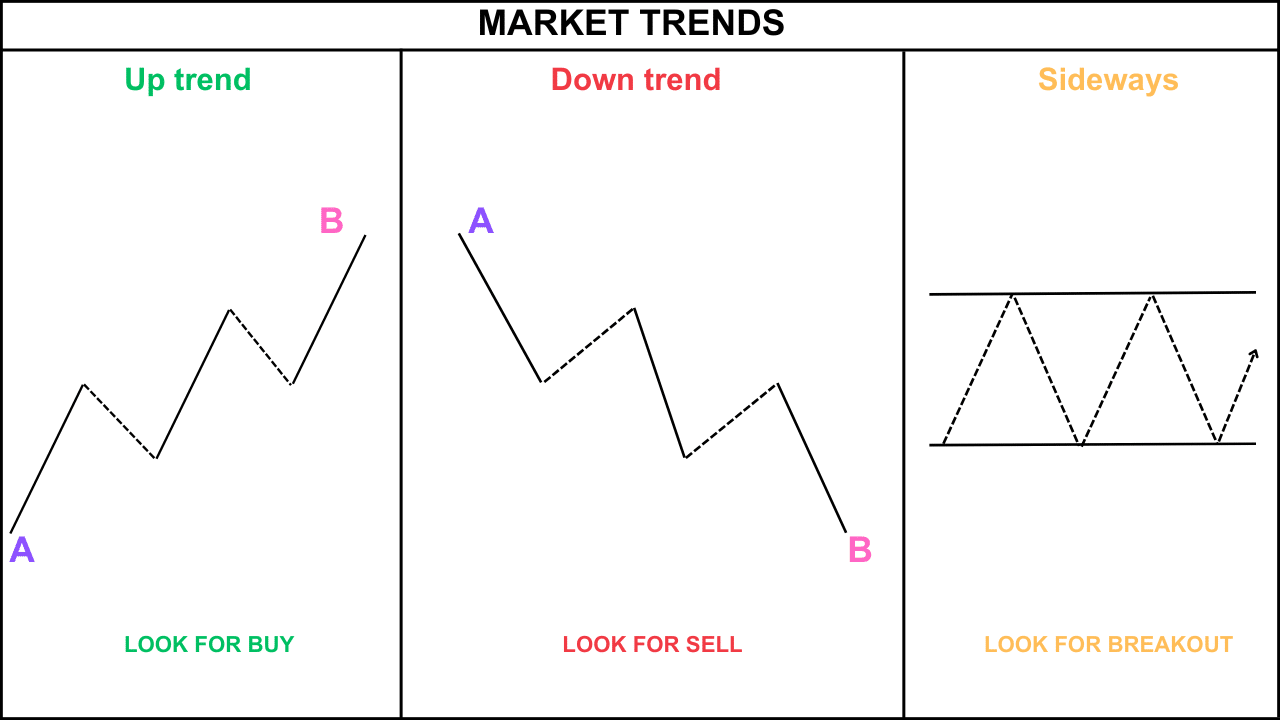

Types of Trends

There are two types of trends. If the buyers have more control than the sellers, then the market will move upward.

When buyers and sellers are equal, the market will be sideways. Conversely, if sellers have more control than buyers, the market will move downward.

There are only two types of trends in the market

- Up Trend:- Higher High – Higher Low

- Down Trend:- Lower High – Lower Low

What is Uptrend?

An uptrend occurs when prices consistently form Higher Highs (HH) and Higher Low (HL) in the market.

Sometimes, the Higher High may not form, but unless the Higher Low has not broken, it’s still an uptrend.

In simple terms, a Higher High and Higher Low pattern occurs when the current candlestick is consecutively higher than the high and low of the previous candlestick.

It shows that buyers are in power and taking prices up.

Examples of Uptrend

Here are some chart examples of Up Trend Structures to understand it clearly.

What is a Downtrend?

In a downtrend, prices consistently form Lower Highs (LH) and Lower Lows (LL) in the market.

The pattern of Lower Highs and Lower Lows shows that the sellers are in control, pushing prices down.

It’s important to note that in some cases, Lower Lows may not form, but as long as Lower Highs continue to form, it’s still considered a downtrend.

This market structure can last for an extended period, and traders must be patient and disciplined to avoid making impulsive decisions based on short-term fluctuations.

Examples of Downtrend

Here are some examples of Downtrend Structures to understand it clearly.

What is a Sideways Market?

Sideways, also known as ‘Consolidation,’ is a market structure where price gets stuck within a price range. (We can also say between supply zone and demand zone)

In a sideways market, we look for a breakout when the stock is consolidated.

Examples of Sideways Market

Here are some examples of Sideways Structures to understand it clearly.

How to Identify Trend Reversal?

When you identify a trend reversal, you can exit your current positions and enter a new trend. Identifying a trend reversal may be easy, but impatience leads to losses.

How Do We Identify Uptrend Reversal?

When a stock’s price fails to make new higher highs and higher lows continuously and instead breaks the higher low with a lower high, it indicates that the uptrend has changed to a downtrend.

However, it is also possible that the higher high can break the higher low, in which case we must wait for confirmation of the new lower high and lower lows before determining the trend.

Examples of Uptrend reversal:

How Do We Identify Downtrend Reversal?

When a stock price cannot create a new lower high and lower low consistently and instead breaks the lower high with a higher low, it means the downtrend changes to an uptrend.

Sometimes, the lower low can also break the lower high, but in this scenario, we must wait for confirmation of a new higher low.

Examples of Downtrend reversal:

Conclusion

Understanding trends is crucial for making informed trading decisions. There are two trends in the market: uptrend and downtrend, and traders need to identify the moment when the trend shifts direction to make profitable trades.

It’s also important to remain patient and disciplined during minor price fluctuations and avoid making impulsive decisions based on short-term fluctuations.

Identifying trend reversals is essential, and traders must keep an eye on the market to spot any shifts in supply and demand.

With the knowledge of identifying trends and trend reversals, traders can make informed and profitable trades.

Explained in very easy manner. Thanks understand clearly.

Thank you for reading!! Stay connected for more awesome content!